IRS Announces HSA & HDHP Limits for 2022

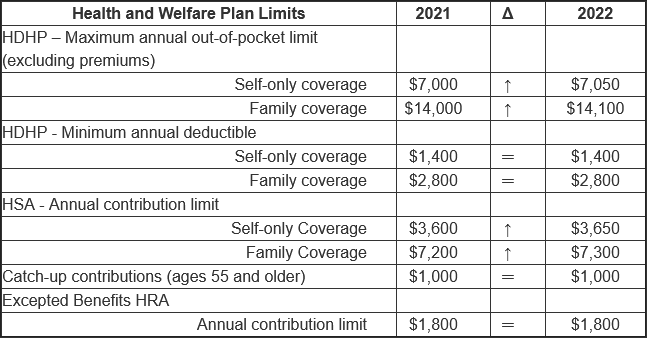

Many of the dollar limits currently in effect for 2021 will change for 2022.

The HSA catch-up contribution for individuals ages 55 and older will not change as it is not subject to cost-of-living adjustments.

Table comparing dollar limits between 2021 and 2022:

Plan sponsors should update payroll and plan administration systems for the 2022 cost-of-living adjustments and incorporate the new limits in relevant participant communications, such as open enrollment and communication materials, plan documents and summary plan descriptions.

It’s difficult to find educated people on this subject, but you seem like you know what you’re talking about! Thanks

Appreciate the comment, take care.

Veronica Pineda